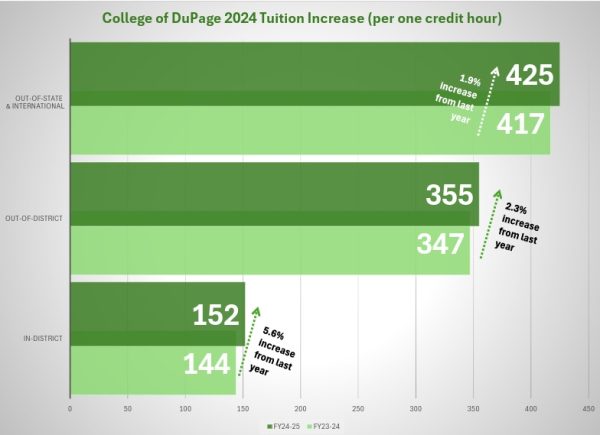

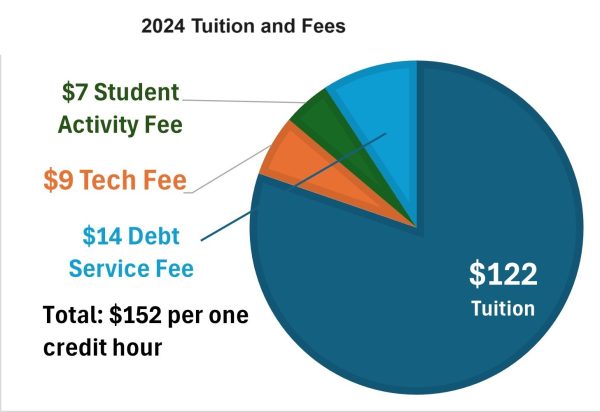

Students registering for their fall courses at College of DuPage will have to reach deeper into their pockets following a decision to raise tuition for a third straight academic year. College administrators are preparing for the possibility of increased reliance on financial aid and scholarships. The tuition increase is $8 per credit hour. In-district tuition and fees rose from $144 to $152 per credit hour, out-of-district tuition from $347 to $355, and out-of-state international from $417 to $425.

The increase for the fall 2024 semester was approved by the COD Board of Trustees at the March 21 meeting, after they amended the motion from a $5 increase to an $8 increase.

Trustee Maureen Dunne and student trustee Rai abstained from the vote, while chair Maureen Fenne, vice chair Heidi Holan, secretary Andrew Manno and trustees Florence Appel and Nick Howard voted “yes” to ultimately pass the motion.

The approval came after much discussion between the trustees and faculty from the Budget and Financial Aid departments. Howard explained why they need to raise it more than $5 to accommodate the needs of a larger student body since enrollment increased by about 8% in spring 2024. The current tuition of $144 is $13 below the state average. COD is ranked tenth lowest in tuition costs out of 39 Illinois community colleges, according to the COD Financial Forecast presentation in February.

“We are the top junior college in the state. We need to move towards the average,” Howard said during the meeting. “There are some institutions raising as much as $25. We can’t move towards the average all at once, but we can take much larger steps than we have been taking in the past. We were at $144 in 2015, we are back at $144 in 2023. That gully cost us close to 22 million uncompounded dollars, that’s 22 straight million dollars in revenue that we didn’t collect.”

In FY 2023-24, the in-district tuition was $144 per credit hour, it was $140 in FY 2022-23, and $138 in FY 2021-22. Howard also mentioned how salaries are consistently raised by 3% per year, and union contracts also rise regularly. Having increased the tax levy as much as they could, the trustees decided an $8 increase would best support the needs of a growing budget and steady inflation.

Rai said she had sought feedback about the possible $5 tuition increase from SLC students, but not the $8 increase.

“What students don’t want is a shock to the system,” Rai said. “We were almost done a disservice by freezing that tuition 10 years ago. That’s now affecting a specific population of students in a big way, and future students will be fine. Students that it hit today have to absorb that shock. That was the majority of the discussion that we had. There were mixed opinions on the $5 [increase], but I felt prepared to vote on that. I’m not sure if I feel prepared to vote on the eight. I think it makes sense fo

r us to wait so I can have a longer conversation with students.”

Rai abstained from the vote because it could not be delayed. Due to fall enrollment beginning in April, the tuition increase had to be decided upon by March 31, or else students who registered before wouldn’t be charged the updated tuition price.

Fenne agreed with an $8 increase and explained how Pell Grant eligibility was taken into consideration by the trustees in their February meeting. Increasing scholarship funds and financial aid packages remains an important priority.

“We considered what we had done last year with the $4 increase and then having concern for the students who didn’t qualify for Pell Grant, and then fell between the cracks for scholarships and financial aid,” Fenne said. “We really found that not many students took advantage or were eligible for that. So we’re considering that the Pell-eligible students won’t be at a disadvantage for this increase.”

Approximately a third of COD students apply for federal financial aid or other funding, according to Diana Del Rosario, the assistant provost of student affairs. She assured the board that the federal budget for the Pell Grant has been approved and would be beneficial when evaluating the financial aid needs of COD students this fall.

“In preparation for next academic year, in the budget for scholarships, I did put in a request with the support of the budget team of $200,000 for next year as a short-term support line,” Del Rosario said at the meeting. “So that we can supplement students who may not have enough financial capacity to set up a payment plan, or because of the delay of federal financial aid, may get put into a situation that at least a portion of their initial payment they may need support with.”

Due to delays within the Department of Education in processing 2024-2025 FAFSA applications, the Financial Aid office is disadvantaged in preparing financial aid packages.

“This is going to be a unique year because we have the federal government late, where we have not received FAFSA information,” Del Rosario explained. “We don’t know how many students are gonna be on the pipeline coming to us requesting federal financial aid… As of this week, we have 12 records from the Department of Education, where usually we have thousands.”

Nicole LaCognata, the Senior Director of Student Financial Assistance, Veterans Services and Scholarships, also commented on how the Financial Aid department is working to accommodate the tuition increase despite FAFSA setbacks.

“The office has made FAFSA completion a priority by hosting a multitude of FAFSA events, as well as providing students with reminders and resources to complete their 24/25 FAFSA,” LaCognata said. “The office is working diligently to make sure that students receive their 24/25 awards as soon as possible. Additionally, the new 24/25 FAFSA form is designed to increase the number of students eligible for the Pell Grant, as well as the number of students receiving the maximum Pell Grant.”

Rai mentioned her observations from discussions with students who are hesitant to apply for the Pell Grants and scholarships that require FAFSA.

“There is a group of students that’s above the Pell line that’s hit hard by it [tuition increase],” Rai explained. “There’s students that are impacted by it financially, could benefit from it, have a hardship, but there’s a gap between them actually accessing the things they need. I don’t have a full understanding of why we’re seeing low numbers. I don’t know if it’s because they don’t actually need it, or if they need it but for some reason there’s some barrier to them accessing it.”

Del Rosario mentioned that the Financial Aid department plans to increase the promotion of scholarships and aid packages to address this, such as bringing a scholarship coordinator on board to manage scholarships. Administration members pointed out that all but one of the 400 institutional scholarships were awarded last year. Available COD scholarship funds will be increased next year through the additional $200,000 budget, according to Del Rosario, as well as new financial aid packages.

One new package is the Tuition Gap Fund, which will award a maximum of $150 to a student for the 2024-2025 academic year, which could pay for almost one credit hour.

“The institutional scholarship budget has increased for the 24/25 year, and there are more diversity and inclusion scholarships being made available,” LaCognata said. “The Tuition Gap Fund, facilitated through the Financial Aid Office, was designed to help students cover the costs of the increased tuition rate. The amount is capped at $150 to target the amount of the increased rates. Students can apply via the scholarship application and are awarded on a first come first serve basis.”

She also mentioned multiple other need-based resources including, an Emergency Funding Program, the Tuition Gap Fund, the Fuel Pantry, loaner laptops, Hotspots and gas cards for students in a CTE degree or certificate program.

In addition to economic aid, other student academic support resources are being strengthened across the college, including in the Library. Lauren Kosrow, who is a Digital Content and Open Access Librarian, said free Open Education Resources can replace textbooks and eliminate course material costs.

“Over the last four years of this program, faculty at College of DuPage have saved students over $4.5 million by switching to open course materials,” Kosrow said. “We know that textbook costs can be a significant burden to students in their higher education journey, and this program is designed to increase the use of OER at COD in order to help eliminate financial barriers to student success.”

Kosrow and faculty at the Board meeting expressed shared sentiment that they hope academic resources such as OER, as well as the scholarship and needs-based aid packages, will relieve stress that may be caused by the tuition increase.

“In the library, we support the COD mission of providing a high quality, affordable educational experience by making valuable information resources available to students as well as technology, software, and study resources—all for free,” Kosrow said. “But we are just one part of a much larger team of people here at the college who are dedicated to supporting students in their educational journey by providing access to services, resources, and spaces to help them be successful.”

For more detailed information, visit cod.edu/costs/tuition/. As the $8 increase is implemented this fall 2024 semester, students can apply online for financial support from the Office of Financial Aid, seek scholarships on cod.academicworks.com, and use needs-based resource support through COD’s Career and Technical Education webpage.