You gasp at your recent bank statement. You didn’t expect your gas, food and other costs would take up so much of your balance within such a narrow timeframe. You are trying to save up for future expenses, but it is difficult as current transactions and necessities seem to eat away at what you earn.

The above scenario is an experience many students today relate to. Despite economists asserting that the nation is not currently facing what would be deemed as a recession, a recent article from U.S. News & World Report states that an upcoming recession is possible.

Andre Guerra, an associate professor of economics at College of DuPage, acknowledged the effect of the COVID-19 pandemic on rising costs and the resulting challenges that come with inflation.

“Inflation did go up after COVID,” he said. “The cost of living increased significantly. Now it’s back to just around 2.5% to 3% depending on the measure you make. So it’s going back to normal, but it’s going to take a while for people to get used to higher prices. Because prices are not gonna come down. We’re not gonna have deflation.”

Guerra explained wage raises and price spikes often coincide, which can impact people’s perception of their personal finances in relation to the overall economy.

“Wage gains happen a little bit before inflation,” he explained. “They happened also at the same time, but they started a little bit before. So you feel richer, and then the inflation is gonna be taking away from that.”

Linda Kozlowski, COD’s Fuel Pantry Adviser, provided additional insights on how inflation has impacted food security in particular.

“[Post-pandemic inflation] has greatly impacted all the food pantries in the area and even the food bank, which provides low-cost food to the food pantries,” Kozlowski explained. “It’s a real and growing problem. It was estimated in 2020 that 38% of community college students are food insecure, and I wouldn’t be surprised if that number is higher now. The pantry grew from serving 70 students a month at the start of 2023 to seeing 400 students a month shopping in the pantry last semester. Since food prices don’t show any sign of going down, I expect those numbers to rise with the fall 2024 semester.”

Sabrina Ali, a psychology student at College of DuPage, said she tries to project her spending habits and plan accordingly despite not having a set budget.

“I don’t really do budgeting. I just buy whatever is cheapest and try not to spend too much,” she said. “A way to save money could be to eat food at home before going out to eat with friends, so you don’t spend too much out of hunger. I always like to check the menu beforehand to add up how much I’ll spend.”

Guerra noted many students now are underpaid on account of working significantly fewer hours a week, minimizing their earnings.

“Many times our students can only find part-time employment,” he said. “It’s not like you can get 20 hours here and 20 hours elsewhere because employers don’t tell you the schedule ahead of time. So it makes it challenging. So many people are underemployed in terms of hours. They want to work more hours, but they can’t find an employer who’s willing to hire them full-time.”

Guerra acknowledged the prevalent impact of consumerism and the pressure to spend on trending items upon the youth. He encouraged people to reflect on how their consistent spending habits will impact their savings in the long run.

“When people make more money, they spend more money,” he said. “All the pressure is to spend money in our culture. You have to buy the things that other people have. You have to have certain things. I don’t think as a nation, we’re very wise on how we spend our money. People have to be careful [and ask], ’Is this really a need?’ If you spend $5 to $7 every day going to Starbucks, it’s going to cost you about $2,000 a year, and if you’re making $28,000 a year, that’s a significant portion of your income.”

Guerra emphasized the importance of obtaining a degree or certificate, noting the long-term benefit it has upon boosting people’s salaries. He added that people should make it a point to complete their degrees. He also urged those job searching to prioritize seeking jobs that value their employees.

“Students have to find a path towards completing their degrees,” he said. “If they’re going to go to a four-year university to make sure they complete the programs. If they’re going to complete a certificate and go to the job market, make sure they complete the certificate because if you are in a school, that’s contributing to your debts.

“Try to get jobs that pay more. Keep shopping around for jobs that treat you well, that give you opportunities and pay better,” Guerra said. “Make sure you value yourself in the job markets as well.”

Kozlowski stressed that the COD food pantry is available to help students meet their basic needs, so they never have to sacrifice their goals, no matter what their situation may be.

“I would encourage every student to get registered for the Fuel Pantry as soon as they start at COD,” Kozlowski said “By doing this, they are free to stop in whenever there is a need, which can sometimes be unexpected. Some of our clients shop each week, others just stop in to shop when an unexpected bill arrives. Maybe the books they need are more costly than they thought, or their car needs repair, and they’re having trouble getting all their bills paid. We’re here to help students make ends meet, and help them stay in school and keep pursuing their goals.”

Kozlowski noted that among the groceries the Fuel Pantry provides is fresh produce from COD’s Fuel Garden, which is grown right on campus and is provided to students to enhance their diets.

Guerra added that paying with cash as opposed to cards helps in keeping track of finances and tends to minimize overspending.

“There is plenty of research that says people spend more by paying with cards,” he said. “When you spend with cash, people tend to spend less.”

He also encouraged students to shop selectively, compare prices and resist the urge to impulse buy online out of convenience.

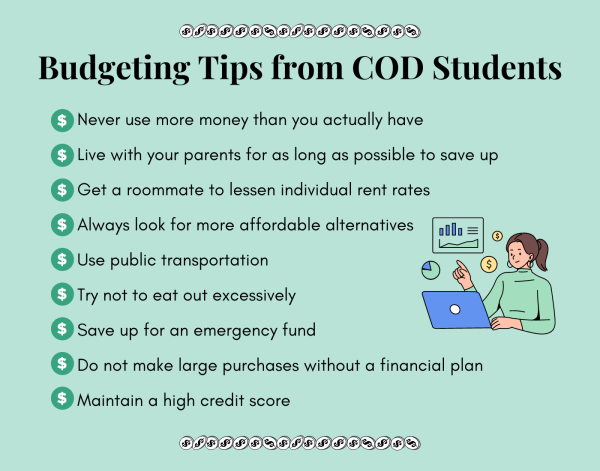

More tips for budgeting and financing from a Courier student survey are included in the graphic below.

Kozlowski invites students to register for the COD Food Pantry. Students just need to register once at cod.edu/pantry or fill out an application in person. No financial information is asked of those who register, and the pantry is open once a week to provide free groceries.