The College of DuPage Board of Trustees has begun to consider an increase for the fall 2024 semester. Faculty and the trustees will be considering the best tuition raise plan over the next two months, and it will be finalized at the March 21 meeting. Between that time, students, faculty and community members have the opportunity to share their input with the board, through email correspondence and public comment at the February meeting.

At the Jan. 25 Board of Trustees meeting at COD, the Long-Term Financial Forecast presentation from Chief Financial Officer Scott Brady gave information about a proposed tuition increase plan. It would raise tuition from $144 per credit hour in spring 2024 to either $147 or $149 per credit hour in fall 2024. A similar increase would be implemented in the out-of-district tuition, which is currently $347 per credit hour.

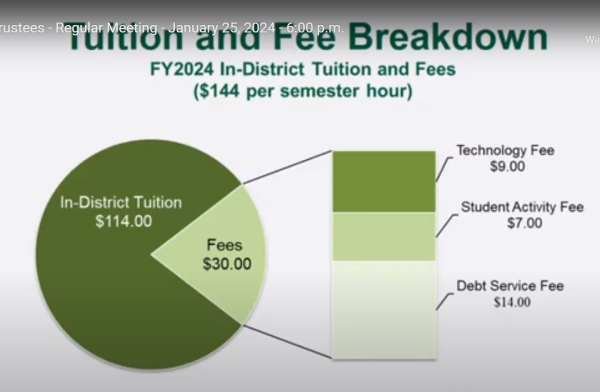

In spring 2024, the in-district cost for a typical three-credit class is $432, plus additional charges like the nine-dollar Technology Fee, seven-dollar Student Activity Fee, and $14 Debt Service Fee.

During the presentation, Brady said most other community colleges in Illinois have higher tuition than COD. Of 39 community colleges compared in the financial report, COD ranks as the 30th cheapest college with its $144 per credit tuition. COD’s $144 per credit hour is $13 less than the Illinois average of $157 per credit hour.

However, students also cite this affordable price as the reason COD has one of the highest student enrollment rates of surrounding Illinois community colleges. Based on the COD Research and Analytics Department’s Student Demographics chart, there were 23,216 students in fall 2023 and 12,466 of them were full-time. This includes many students from outside of the 502 district who pay higher tuition, with 19% of students being out of district and 78% in district in fall 2023. The rest were either out-of-state or international students.

In the perspective of some students, COD’s higher student population allows it to make up for lower tuition while maintaining affordable and quality education. Psychology major and freshmen at COD, Ammu Khan, gave her thoughts on the tuition increase.

“A key highlight of attending community college is the lessened tuition, especially considering most students work minimum-wage jobs and have other responsibilities,” Khan said. “I think that despite having lesser tuition than the state average, COD is able to provide a plethora of degrees, certifications and programs for its students. These opportunities should not be discriminated against those who cannot afford tuition rates, considering that it is a community college.”

While financial aid through federal means, such as through FAFSA or the Pell Grant, is helpful, some students worry about student loans and debt. The COD Foundation also offers scholarships, though most are program-specific and are sometimes only allocated to specific costs, like textbooks, rather than tuition.

Khan said that for students who may struggle with tuition and other college costs, it’s good for COD to have support systems that alleviate these challenges.

“While COD does have plenty of systems in place to provide financial aid for students, many students are unaware of them as they are not as publicized,” Khan said. “For example, the scholarship system is not kept up to date or efficient enough for students to be able to financially plan their academic careers.”

In response to the explanations of budget funds needed by the college, Khan mentioned that it would help students to understand where tuition increase gains will be allocated.

“I understand that colleges and schools need funding, but rather than raising tuition, perhaps better allocation of the funding that is already there is a better alternative,” Khan said. “I think a tuition increase could help COD, but depending on how drastic COD’s financial situation is, they may need more than a $5 increase. I think it’d be helpful to know specifically what COD is planning on allocating the new tuition to.”

The Financial Forecast report presented at the BOT meeting detailed the expected revenue sources and expenditures for COD in Fiscal Years 2025 to 2029. The expected fall 2024 semester tuition raise will be put in place during FY 2025, which will start Sept. 29, 2024 to Sept. 27, 2025.

In FY 2025, enrollment is expected to increase by 1.5%, property tax will increase by 4.4% in 2024, and state funding will remain at a flat $18 million per fiscal year.

The financial faculty and trustees also discussed the way the budget must be balanced and tuition increases are needed. During the BOT meeting, trustee Nick Howard explained how the tuition increase should account for inflation and can be allocated to more student services.

“When we look at very practically, if the message is keeping up with inflation at a minimum, we should be at the $5 [increase],” stated Howard. “We talk about mental health being an important part of what we’re doing here in school. We talk about Sodexo putting some effort towards kids getting fed here in the proper fashion. We have a lot of opportunities to not only get on the right path and to justify what we’re doing here from a cost standpoint. That’s the message that’s important to see. We can’t just see what the story is now, but what the story is coming from. It’s tough to look at when we see the lost revenue.”

Student input on where tuition can be allocated is also helpful to the Board’s decision.

“I personally have the privilege of having a college fund, so tuition itself isn’t so much of a struggle for me. However, additional fees and charges, especially ones that are not made known up-front but are necessary, add up,” Khan said. “I think that the new tuition could go towards textbooks and technology fees since a lot of students aren’t able to afford all of their necessary textbooks for their respective classes, and they could provide better technology for students who need it,” Khan stated.

In the BOT meeting, Brady stated the budget is about $190 million, so there’s a $10 million or 5% variance. President Brian Caputo also encouraged faculty to use their allocated funds so that the unspent money wouldn’t constitute budget deficits that could cause funding to be cut.

“To clarify a point, what we’re trying to do is encourage the staff to spend what they ask for, generally speaking,” Caputo said. “What happens is we have a lot of surpluses over the years, and some have ended up in the $10 million to $20 million range. What it does is crowd out other items out of the budget that would have been put in, because we were trying to somehow keep the deficit from looming. With this, we’re trying to keep it more narrow. So if they really need it, they can ask for something. The 5% range still gives us a pretty big amount of flexibility. The point is to budget responsibility and spend what you can.”

The next Board of Trustees meeting will be on Thursday, Feb. 15 at 7 p.m.