Student Debt Crisis Exceeds $1.4 Trillion Dollars

October 10, 2018

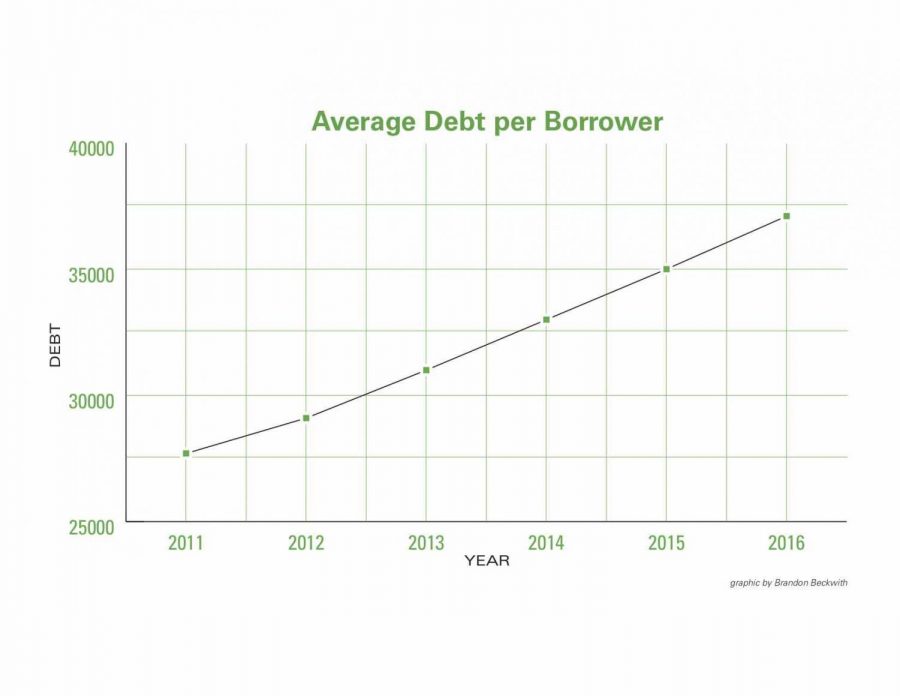

College of DuPage and other Illinois students are part of the more than 44 million students in the U.S. who have debt from higher studies, a total exceeding $1.4 trillion dollars, according to a New York Times article by Tara Siegel and Karl Russell. In 2006, the national student debt was $101 billion and has increased exponentially since then.

A recent National Postsecondary Student Aid study highlighted the amount of student debt exceeding any national auto or credit card debt. The study continued to show that 1 million students fail to pay loans on time, and another 40 percent of students with loans are expected to join them over the next four years.

Illinois students and graduates have mid-ranged student loan debt. Publisher and vice president of research at SavingForCollege.com, Mark Kantrowitz, found that approximately 66 percent of local students have school debt with the average bill being $29,000. In the District of Columbia however, students have the highest average debt, with a cost of about $40,000 per student.

Since last year, U.S. Dept. of Education Secretary Betsy DeVos began to ease up on consumer protections for student borrowers. This lead to federal loan programs lending out larger loans to students who did not show proper evidence as to how they will repay the companies.

Now, six states and the District of Columbia are contributing their own efforts to crack down on unlawful lending practices. There was a “statement of interest” supporting a lawsuit from the Student Loan Servicing Alliance, which was filed by lawyers for President Donald Trump’s administration. The companies would now be required under a new state law to be licensed and could lose their right to operate if they engage in unlawful loans. The statement was against the District of Columbia for creating a student loan court office.

The student debt crisis started to become a much larger problem back in 2008. After the Great Recession, colleges began giving out larger scholarship amounts to lure first-time students. A study done by Ruffalo Noel Levitz showed discount rates for out-of-state students were at 23 percent unlike in-state students who had discounts at 16 percent. It’s evident that out-of-state students have become more desired to public colleges over the years.

Students are also changing majors to secure a job as soon as they graduate college so they can pay off their loans, delaying any long-term plans. A study done by Georgetown University showed 99 percent of the 11.6 million jobs created in the U.S. since 2008 require some education or training beyond a high school degree.

According to the National Center for Education, business, health and psychology are now the most popular degrees for college students. As these career paths continue to gain popularity, students have lost interest in philosophy, education and English literature over time.

College presidents have also focused on short-term stability for their institutions over long-term goals. Instead of focusing on larger projects and resourceful ways to investing the school, many presidents wait for low enrollment and debt to pass.

Students have a variety of ways to conquer or avoid most student debt. Similar to College of DuPage, most two-year junior colleges offer 2 + 2 programs. These programs are for students to take transferable classes at a smaller, less expensive institution and then transfer out after two years to a larger four-year school.

Students attending a two-year community college spend an average of $4,000 annually compared to a student at a four-year university who spends an average of $25,000 annually based off of National Center for Education Statistics.

These savings do come with a price, as students at two-year institutions are not offered living spaces, meal plans, activities or the campus culture a four-year university has.

Another way students can avoid debt is by taking online classes. Arizona State University has done this with its Global Freshman Academy. These freshman courses are offered online to anyone around the world. A credit fee of 200 USD per credit isn’t charged until after students complete the course. Some schools even offer free online classes to students considering different majors. These classes come in the form of iTunes podcasts and online coursework.

DeVos also plans to make data on two-year institutions, like COD, available to students and recent high school graduates.