It pays to register early

Q&A with Janet Pagan-Klehr, Manager of Financial Assistance

November 18, 2015

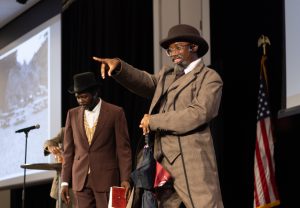

Manager of Financial Assistance Janet Pagan-Klehr in the Financial Aid office at College of DuPage sits down with us to discuss the different rules and limitations on the different types of financial aid COD offers.

Courier: What are the federal and state scholarships and what do they go towards?

Janet Pagan-Klehr: We have the state MAP grant [Monetary Award Program], and that goes towards tuition only. Then we have the Federal Pell grant, and some students qualify for a program call FSEOG [Federal Supplemental Educational Opportunity Grant], and those are both free grants. You don’t have to pay them back and then students also qualify for a direct subsidized loan or a direct unsubsidized loan; those are truly loans that students have to pay back.

C: What are the rules to these programs?

J P-K: For the loans, students have to be enrolled in 6 credit hours, for all grant and state programs they have to maintain a 2.0 GPA, they have to take classes that pertain to their degree program, students have to be in a degree program, students have to take classes within their program of study and a lot of students don’t understand that.

C: How does COD try to make these rules more apparent to students and how do you think they help or not help [with the understanding of the rules]?

J P-K: Our website has most of the rules that are out there. It’s a lot of language. Our population of people don’t want to read and they want the quick answer to move forward, which is normal. We send email communications to students and students come in here and ask questions and we have walk-in availability for students who might have a question on their financial aid.

C: What is the most unknown rule to the the population of students who apply for these loans?

J P-K: One of the challenges that I think we have as an office is letting students know that they have to register early, because if they register late, financial aid does not cover [tuition]. Students have to be participating in class from the first day. Students might register for a class and then not attend it until 2 or 3 weeks into it and that’s a big no-no when it comes to financial aid. We do do attendance verification for financial aid students, so it does implicate their financial aid and it does have a negative effect if they aren’t participating in class.

C: Are there any ways around the financial aid rules?

J P-K: Rules are meant not to be broken. There are exceptions, but it’s a case by case basis, there isn’t one set way to get around the rules.

C: What is one thing you would tell students who need to get financial assistance?

J P-K: Apply early. The application comes out in January for the upcoming school year…which is important for the MAP funding, with the budget impasse currently and MAP funds going quickly, it’s important to get in your application in order to be MAP eligible. Also we have federal funds like the FSEOG…those funds run out early too because we only get a certain dollar amount and then we award those [and then the funds are gone]. Its also important for students to apply early so that their financial assistance can be processed earlier. They don’t want to wait until August when classes start because thats our peak processing time and it could take four to six weeks to process the application; whereas if you do it in April were only talking about a couple weeks tops [for processing].

C: How many students at COD benefit from financial assistance?

J P-K: Right now we have about 12,600 students on all types of financial aid including scholarships.

C: Do you think the number of students using the resources available to them is low or high?

J P-K: Considering what our current population is, its a good number. I think it’s probably on the higher end.

C: Is going online the only way students can learn about their financial aid options?

J P-K: Often times we partner with admissions, well go out to the high schools, we do adult nights, we do a FAFSA (Free Application for Federal Student Aid) night, we have a FAFSA lab that’s typically open March through May that’s similar to the my access lab that helps students with FAFSA processing. It’s open during that time period because that’s when students are finishing up their taxes and parents are finishing up their taxes and they want to start applying for financial aid, so we have that time frame open in order for students to drop in and get that [information. We try to get the word out to students and parents…all sorts of resources and all sorts of areas we go out to [to give students information].

C: Once a student decides that they want to apply for financial assistance, how involved is the school in the process?

J P-K: The application is online, so we don’t do a lot of hand holding. We will hand hold for a student that needs it..they’ll come in and request it and we’ll walk them through the application process, that’s why we have the FAFSA lab open during certain periods. Students can come in and we can give them assistance as a walk in or appointment based and help them in that way too. The majority of the students do it online. Even on the online version theres help text on FASFA.gov that helps them get through each process and questions.

C: Do you see students trying to get financial aid in the middle of the semester?

J P-K: Were still processing financial aid now. Since we have an open enrollment policy, students can do a FAFSA today for fall semester and still get reimbursed as long as they meet the eligibility criteria. We don’t recommend they wait that long to get that money to be successful, if you wait too long…there’s a hardship on the student if they are waiting this long to get their book money…It’s a disadvantage to the student if they wait this long.

C: What if a student is undecided and would like to get on financial assistance?

J P-K: Unfortunately we cannot award financial aid to students who are undecided. At that point in time they just wouldn’t get a package because the department of education says they have to be in a program of study.

C: How much do these grants cover – can it be the full amount of tuition?

J P-K: Financial aid is based on need. So if you have an EFC (expected family contribution) of zero, you could get, for full time enrollment, $5,775 for the academic year, so fall and spring. The lowest the amount for a student, for an EFC of $5,198, you can $313 for full time enrollment. This is referring to the Pell program, the free money, it’s broken down by the number of credit hours you’re here for…It depends where you end in that EFC range.

C: Say a student’s EFC range goes from total tuition being paid to zero due to unforeseen circumstances; can a student still receive aid?

J P-K: Everything is based on the prior tax year. If a student in a family did their FAFSA and they had enough funds to pay for financial aid, and then one or both parents lose their jobs, then they can do what’s called a special conditions. They can come in and show documentation that they’re no longer working and that their income has drastically changed based on the documentation. We can do professional judgement and make an assumption on the income. And make an adjustment based on that. Then they might qualify for more financial aid and then continue on with school. There are certain things that as professionals that we can make adjustments to. It’s all based on documentation because if we ever get audited we have to show that the documents are in house and on file.”

Q: What if a student can not provide legal residence proof, is there any way that they can get financial assistance to help with their education?

J P-K: Per federal regulation undocumented students do not qualify for federal financial aid, but they might qualify for scholarship money. So it’s encouraged that undocumented students do complete FAFSA because it could affect their eligibility for scholarships at another institution.

C: Anything else you’d like to add?

J P-K: I can’t stress enough to apply early. Thats our biggest thing, students wait til the last minute. Even if you’re not sure whether youre gonna come to school and apply, that’s the biggest hang up there. Then the students are rushed to do everything and i don’t want to see a student rushed to do something and not do it correctly or hold up their education. Think a little bit ahead so that we can process the financial aid and students can be successful. Thats our goal in this office, we want students to be successful. If they’re gonna come to college of dupage, we want to see them graduate, we wanna see them succeed in…whatever their career choice may be, that’s our main goal…that’s why I wouldnt wait to apply for financial aid, it’s a complicated process. Sooner is definitely better.