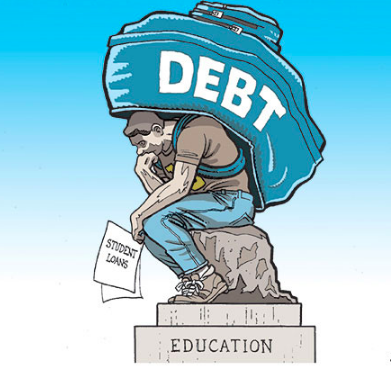

I cleared my student loan debt, but my method is not for everyone.

September 27, 2018

Last year, I finally cleared the debt from my undergraduate degree. It took eight years, a generous wedding gift from my parents and some tough choices, but being free from the burden of a $27,000 debt felt like a fresh start.

Then I decided to go back to school. After paying for my first two semesters out of pocket, I finally realized I needed to get a loan again, and it felt like failing. The old adage came to mind, “one step forward and two steps back.” The investment in my future would make it all worth it, and I knew I could pay it off again, but as I thought of the next round of tough budgetary choices ahead of me I was reminded of how I paid for my first degree.

Although I made choices, like living overseas, I currently cannot repeat, they are definitely not regrettable. In fact, despite all the challenges I faced it was still the best decision I have ever made. Considering this, I thought I would share how I paid off my loans, but I do not want to frame this as a how-to-guide. They are already everywhere on the internet.

“How I paid off $28,000 of student loan debt in two years,” “How I paid off $22,000 of student debt in six months”, “I paid off $180,000 in student debt in eight years. Here’s how…”

Articles that are designed to lure us in, the indebted, with implications of an easy way out from under financial burden. The answers provided are far from solutions for most of us. The further you read the more you realize there is no magic pill, and the answers are always in the same vein.

- Make goals and stick to them.

- Cut out all unnecessary expenditure.

- Work a second or third job.

- Live like a hermit in the cheapest place you can find, only leaving to go to work.

- Sacrifice friendships, hobbies, health and sanity.

- Rely on financial assistance from your parents.

- Cry a lot (presumably.)

Is that all? Totally do-able. I can’t imagine why everyone isn’t already jumping on board the misery train.

Taking into account this advice, students must question whether the ends always justify the means? I would argue no. A bare-bones budget may help you pay off your debt faster, but it can also leave you socially isolated and can set you up for a lifestyle without joy, or even worse, failure. This is especially true when considering the spending priorities of Millennials and Generation Z. These younger generations may be saddled with massive student loan debt, but that has not deterred them from spending more than previous generations on experiences and self-improvement. According to a 2017 report from Charles Schwab, younger generations are far more likely to spend their money on eating out, event tickets, electronic gadgets, superfluous clothing and travel. An indication that young people are not solely focused on investing in their future but are instead investing in the now. Notable spending trends include a willingness to spend more on fitness, health and wellness, beauty and international travel.

At the same time, according to a 2017 Forbes report, student loan debt is now the second highest consumer debt in America, totaling $1.3 billion. The Wall Street Journal reported on a Gallup poll from 2014 that found students who borrowed over $24,000 are less likely to enjoy work, are less financially and physically fit and generally self-report as less happy with life post-college.

Another Forbes article reported attitudes around student debt had shifted from seeing it as an investment in their future to a “source of existential dread.”

Millennial personal finance expert Stephanie O’Connell told Washington’s Top News, “those who have student loans to repay need to be “proactive” instead of ignoring their debt. The key is to do something about your loans.”

This is where the solution lies for most students. Do something. The extreme ideas presented by writers online are likely to be ignored by most of us, especially those who find themselves living paycheck to paycheck post-college or who are unwilling or unable to sacrifice absolutely everything to be debt free.

However, some sacrifices must be made, and I certainly made my own.

After I graduated in 2009 I had no idea what I wanted to do. Foolishly, I assumed by the time I had finished my Bachelors of Arts degree I would know how to use it. Further education was the most viable option. Becoming a teacher, getting a certification, going into more debt.

An ad in the paper saved me from having to make a tough decision, fortunately, and three months later I was teaching English as a second language in South Korea. All I had to do was sign a year-long contract and my flights were paid for. While there, I was provided free accommodation, free training, heavily subsidized health care, a monthly paycheck and the opportunity to have adventures and travel around Asia for a fraction of the cost. With so much already paid for, my monthly paycheck was more than enough to pay for transportation and food, especially considering how cheap it was to live there. The cheap living costs allowed me to set aside money for repayments with plenty left over for fun.

There is always a cost, however, and the price I paid was not one that all would willingly bear. A year apart from family, living in a country where few speak English and being thrust into a culture and environment that may not be easy to adapt to. I loved living abroad, but I was not so naïve as to ignore the downsides, and I know it takes a certain kind of personality to thrive despite the challenges and homesickness.

I knew what I was willing to give up so I could earn enough to both pay my bills and debt as well as still go out, socialize and travel. I knew I was not ready or disciplined enough to give up my wanderlust so I could pay off my loans quickly, and my choice to pay it off slowly is something I will never regret.

Everyone wants to get out from under student loan debt, and everyone wants to do it quickly, but if you are going to do it, it will come at a high price. Tackling large debt requires a thoughtful plan that is honest and acknowledges what you are willing to sacrifice.

Think of it like a diet. If you go on a crash diet that is impossible to maintain you are destined to slip up and eat a whole gallon of ice-cream. If you cut a budget down to simply the expenses required for survival it will likewise be impossible to sustain long-term. If you love ice-cream, then budget that into your weekly calorie count. Allow yourself to be treated once a week for the hard work you put in every other day. If you love movies or music or nice food, budget for that. Ultimately, sacrifices will always be made, but acknowledging there are some things you can’t give up is a part of a successful plan.

It is all relative. What is extreme for one person, may seem like a minor inconvenience to another. It all comes down to what the individual can tolerate so that they can achieve their goal.

This time around I acknowledge I cannot teach overseas to pay off my debt as I am now married and settle in the US. Instead, I will live as frugally as I deem reasonable. I will take a second job. I will focus my time on the hobbies I have that do not require significant financial investment, like coloring and Netflix. For those who are facing growing student loan debt for the first time, similar decisions lie ahead. While some may be willing to take the hard and short road, most will choose the long road. Generation Z, those born after 1995, are less likely to take on as much debt as previous generations and are more conservative borrowers. Attending a community college rather than a more expensive four-year university is already a great way to minimize the exorbitant financial burden many other students are signing up for. Going forward, tackling debt is a process of one step at a time. As long as we are consistently making efforts and giving up something for the sake of our future fiscal solvency, we are on the right track.

Whether it takes six months, a year, five years or 10, paying off debt is a personal journey. Take pride in the education you invested in, and be patient with yourself. There is no wrong or right answer and no matter how you plan to reach your goal, when you do finally get debt-free the hard work will always feel worth it.

Darold Barnum, Phd, MBA • Sep 27, 2018 at 3:39 pm

The high cost of college education and backbreaking student loans is indefensible for more reasons that I can list. The current representative for the Sixth Congressional District, Peter Roskam, only wants to cut, cut, cut educational funds for the middle and working class.

Sean Casten, who is running to replace Roskam wants to change this travesty.

Casten supports linking Pell Grants to the rate of increase in college tuitions, so their value doesn’t diminish over time. Roskam does not.

Casten supports an overhaul of the provisions in the 2005 Bankruptcy Bill, which has made it practically impossible to discharge student loan debt even when they have been forced into bankruptcy. Roskam does not support such an overhaul.

Casten supports funding trade-path programs, to provide education and training to match students with the thousands of unfilled high-tech jobs. Roskam just cuts taxes and gives the money to the rich.

So if you live in the 6th Congressional District, I hope you will register to vote if you need to (online at vote.gov ), and vote for Sean Casten!

https://castenforcongress.com/blog/issue/education/