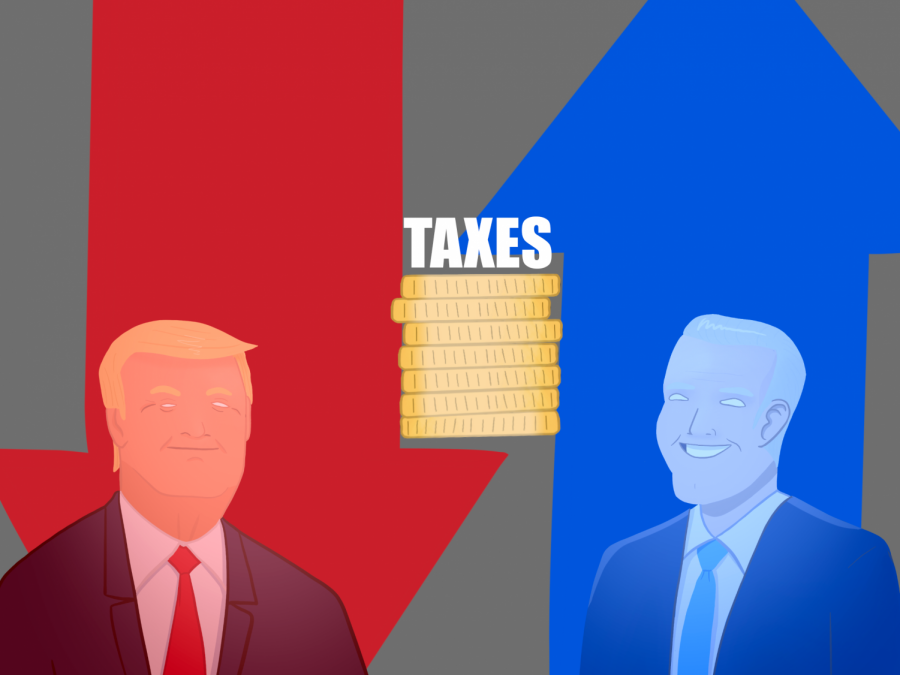

Evaluate the candidate: economic proposals

October 20, 2020

President Donald Trump and former Vice President Joe Biden are approaching the culmination of the 2020 presidential election—what seems to many, as one of the most profound elections in our modern-day history, considering the social, fiscal and societal implications of this year alone. Voting demands participation, not only at the polls, but through close evaluation of the candidates. In the coming weeks, the Courier will analyze some of the most critical policies and pressing topics seen in this current presidential race in a nonpartisan explanation for voters.

While Trump works to enhance the economic policies of his first term (2016-present), Biden is proposing a series of new economic policies in opposition to what has already been proposed and established by the Trump administration. This week, the Courier will be discussing the difference between the two economic approaches and how they can affect the American people.

Next week, part two will be evaluating immigration policy, through the approaches of both the current administration and the Biden campaign.

Throughout the duration of the 2020 presidential race, Trump has presented an economic approach that reflects a continuation of pre-pandemic America. Trump has not recently released a detailed plan on how he intends to fuel the economy, with close consideration to the pandemic, since his budget proposal for fiscal year 2021. The proposal was released in February of this year, prior to the economic setbacks caused by the pandemic, bringing the highest unemployment rate since the Great Depression, at 14.7% this past April.

Trump is proposing tax cuts, which he says will have a stimulatory effect on the economy. These cuts will be implemented as permanent, which would ultimately bring tax revenue down.

“Companies are moving in, car companies are moving into Michigan and into Ohio, and in South Carolina and North Carolina. What’s happening is that they are coming in because we reduced the taxes,” Trump said at the NBC town hall in Miami, FL on Oct.15th.

He also intends on indexing capital gains for inflation. Reducing the level of capital gains consequently reduces the tax on the capital gains.

“Typically,” College of DuPage Economics Professor Jerome Lacey said, “when a corporation invests in and builds a new factory, for say, $2 billion, they have to advertise it. They have to spread it out over several years. This allows them to expense it, take all the deductions in the current year. That reduces their income, and that reduces their taxes.”

All this will reduce taxes to right under $2 trillion. In having to pay for this tax reduction, the Trump administration wants to reduce expenses through the elimination of various programs, or cutting a partial amount of what is normally given to that area within the budget. One area that will be most impacted by these cuts would be healthcare.

Trump plans to reduce the federal component to healthcare—referring to Medicare, Medicaid and the Affordable Care Act. Lacey describes these programs as the payment silo for infrastructure. Approximately $1 trillion will be fueled into infrastructure under the Trump administration, as they plan on totaling this amount from the $1 trillion cuts in healthcare costs.

In addition, SNAP (Supplemental Nutrition Assistance Program)—food stamps, for example—will be cut by approximately 30% overall in his 10-year vision. Education, in regards to student financial aid and work-study programs, gets hit by approximately $2 million dollars. In one year, the Department of Education would suffer a 7.8% decrease in funds, under Trump’s 2021 proposal, according to Investopedia. This would particularly be seen in the complete elimination of Public Service Loan Forgiveness, as well as subsidized loan programs.

The philosophy behind the Trump campaign’s economic approach in this general election is, Lacey said, “If we can get beyond the economic implications of the pandemic, then they can continue what they saw as economic prosperity, pre-pandemic. On top of that, they want to cut taxes even more.”

The Biden campaign, however, proposes an increase in expenses through various programs, which will be paid for by an increase in taxes. Biden, whose campaign has a main focus on restoring the middle class, says any household with an annual income totaling less than $400,000 will not experience any tax increases under his administration.

Instead, Biden intends to raise the top income tax rate back up to 39.6%—from its current standing at 37%—as it had previously been under the administration of former President Barack Obama, while also raising the current 21% corporate tax to 28%. For those with an annual income of over $1 million, taxes for capital gains will be imposed in the same way as their wages.

Through these tax increases, the Biden campaign lays out a spending plan totaling approximately $7.5 trillion, which he says will help stimulate the economy in recovery from the pandemic, over a span of 10 years.

Two trillion of the $7.5 trillion Biden will invest is in education. Half will go to higher education, making public higher education free for families making an annual income under $125,000. This will evaluate student loan debt in terms of an income-based repayment plan. In addition, Biden’s social safety net, including childcare and eldercare, will receive one-third of $1 trillion in immediate action, and $1.5 trillion over the rest of his term.

Biden will invest $2.5 trillion dollars in infrastructure, including transportation and his plan called “Made in America.” Through this he intends to generate the production of goods in the United States, ultimately bringing jobs here and employing masses of Americans, which he says will also stimulate economic growth.

At the first presidential debate on Tuesday, Sept. 29th, Biden briefly explained the vision for his Made in American plan.

“My economic plan would create 7 million more jobs than his in four years, number one. And number two, it would create an additional $1 trillion in economic growth because it would be about buying American. We are going to make this federal government spend $600 billion a year on everything from ships, to steel, to buildings. Under my proposal, we are going to make sure that every penny of that has to be made by a company in America.”

Further information on the two economic policies

The Trump Campaign:

https://www.promiseskept.com/achievement/overview/economy-and-jobs/#

The Biden Campaign:

Jake • Oct 22, 2020 at 4:18 pm

I will say this article is very well written. However you’re not off the hook yet. The immigration article you teased for next week will be tough because that is what got the president elected in 2016. Looking forward too it.