Vaping under fire

The tax attack against the tobacco alternative

December 9, 2015

“If this goes through, I’m gone. I have a lease ready to go in Lake County. I said this last time I spoke in front of you, and I’m prepared,” said Ben Reyes, owner of Colossal Vape in Des Plaines, Illinois, when addressing the Cook County Board of Commissioners about the proposed, and recently passed, tax increase on e-cigarette e-liquid. “My half-million dollars that I did in revenue this year, it’s going to Lake County next year. I’m going to open up in DuPage too. Everywhere I can where I’m not going to have the reach of your grip. It’s insane.”

Cook County’s Board of Commissioners passed a 20-cent per milliliter sin tax on e-liquids containing nicotine, which starts on Jan. 1, 2016.

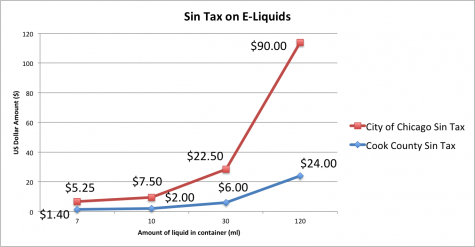

The City of Chicago already had a 55-cent per milliliter sin tax on e-liquids with nicotine before this recent increase, and now puts the city’s tax up to 75-cents per milliliter. As seen in the chart below, this puts the City of Chicago sin tax on e-liquids higher than the Illinois cigarette sin tax of 36 percent of the base price and 9.8-cents per cigarette.

This also puts the sin tax over 100 percent on both 30 ml and 120 ml bottles in Chicago. Based on prices from the popular online e-liquid retailers “Direct Vapor”, “VaporDNA” and “Viper Vape”, a 30 ml bottle is about $20. On top of the 10.25 percent sales tax in Chicago, the price would arrive at $44.50. That is about a 123 percent tax on the product.

With 120 ml bottles, based on pricing from online retailers “Kick-Ass E-Juice” and “Seduce Juice,” the average price is about $25.50. With sales and sin tax added, that’s $118.11. That is about a 363 percent tax.

According to International Business Times, cigarettes cost on average $11.59 per pack in Illinois with sin tax. That is about a 47 percent sin tax. Based on statistics from the World Health Organization, around 6 million people die every year from both first and second hand smoke from tobacco products.

E-cigarettes are used as a proxy to move a person away from their dependency on combustible cigarettes. According to Action on Smoking and Health, 500,000 people in the UK have started vaping, 86 percent of those using vaping to either stop smoking completely or stop relapse to smoking.

Vaporizing and inhaling e-liquids have been proven to be significantly less damaging to smoking tobacco products. According to the Chief Executive of Public Health England Duncan Selbie, “Best estimates show e-cigarettes are 95% less harmful to your health than normal cigarettes, and when supported by a smoking cessation service, help most smokers to quit tobacco altogether”

Although this doesn’t affect DuPage County directly, there are battles users of these products will have to fight in the future. One major battle is a Food and Drug Administration bill that will go through congress within the next year that, if passed, will place e-liquids with nicotine under the label “tobacco product” within the Family Smoking Prevention and Tobacco Control Act.

E-liquids and e-cigarettes have no tobacco in them. According to a study performed by the American Heart Association, the liquid is made of water, flavorings, a base such as propylene glycol or glycerin and nicotine in those advertised containing the drug.

If passed, this will change a few aspects of e-liquid retail across the country. This would place e-liquids with nicotine and disposable e-cigarettes under the tobacco product sin tax. The tax rate is controlled at the state level. In Illinois, there is a 36 percent sin tax on tobacco products, other than cigarettes. With 30 ml being around $20, that would be a $7.20 increase in price. This also adds another 36 percent tax to each e-liquid containing nicotine alongside the 75-cent per milliliter tax in Chicago.

This addition also forces e-liquids to put warning labels on the containers of e-liquids. Based on current warning labels delegated by the FDA, the only label that would make sense for their argument, that they already use, would say, “This product is not a safe alternative to cigarettes.”

Although studies performed by government agencies like Public Health England have come out and said that e-cigarettes are significantly better for you than tobacco, the U.S. government will force a label on these products that can give off misconceptions about the health risks to this alternative of cigarettes.

Even though smoking tobacco products have been the cause of many deaths on average per year, nicotine is not the killer in cigarettes.

According to Forbes writer Sally Satel, “Nicotine is a chemical that is dangerous not because it causes cancer but because it can addict you to cigarettes. As Michael Russell, the father of tobacco harm reduction theory and the developer of nicotine gum, put it in 1976: ‘People smoke for nicotine but they die from the tar.’”

Despite there being substantial evidence that vaping can help smokers break away from their dependency of smoking tobacco through controlling nicotine consumption in e-liquids and e-cigarettes, government agencies are trying to kill of an entire industry by making these products close to, or in Chicago’s case even more expensive than, tobacco products that do significantly more harm to smokers and non-smokers alike.

Although there is little that citizens of DuPage County can do to help vapers in Cook County, we can take action to conserve our current pricing by contacting local government about why we need to leave pricing of these products alone, and how this provides incentive for people to break away from tobacco products. Your Illinois senators are Mark Kirk and Richard Durbin, and you can find out who your House Representative here.

Josh • Dec 15, 2015 at 10:15 am

The proposed tax on eliquids is ridiculous and is really going to hurt small business. There should just be stricter regulation on marketing flavored ejuices to minors.