A Campus Hidden Gem: Free Volunteer Income Tax Assistance

Are you taking advantage of the campus’s opportunity for free money back through the complimentary Volunteer Income Tax Assistance program?

February 21, 2022

Receiving free money sounds like a dream for any broke college student – even free money that you’ve technically already earned. Filing a tax return, regardless of dependent or taxpayer status, can potentially provide that opportunity. College of DuPage is currently offering a free, volunteer-based tax service in the Seaton Computing Center from now through April 16, and that’s where I found myself on an early Saturday morning.

The school’s explanation of the service is tucked away in the Accounting Program subcategory off of the main website. The Volunteer Income Tax Assistance program, VITA, is run in partnership with the IRS and can prepare both federal and state income tax returns for as early as 2018.

The webpage for VITA provides a link to schedule an appointment with a volunteer at College of DuPage’s main campus for any Saturday until the tax due date. The page offers a comprehensive checklist of required documents ranging from proof of identity to income items to receipts of tuition payments. The college has also included a PDF of the crucial 13614-C Intake form for consumers to complete prior to their appointments, although it is also available on-site.

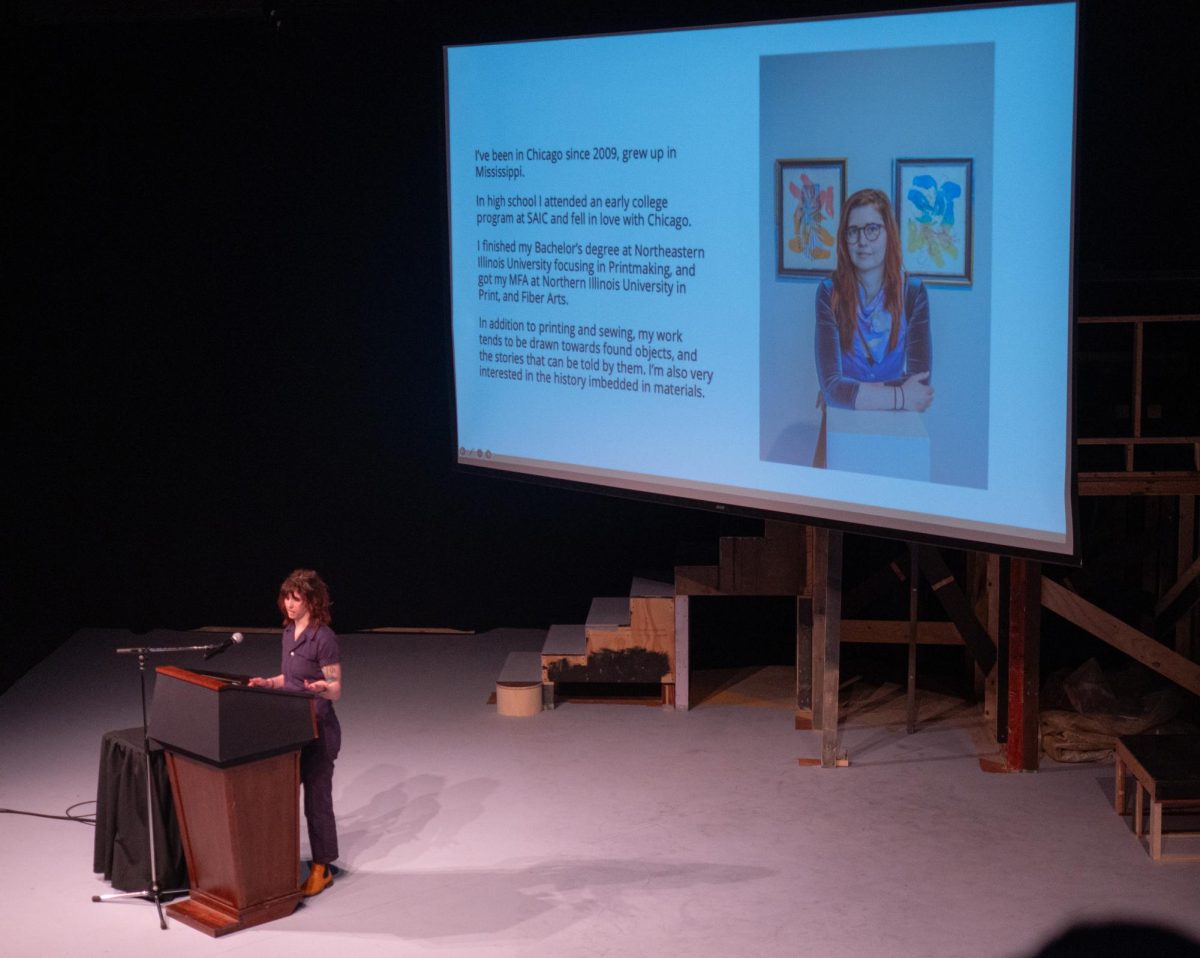

Students enrolled in the ACCOU-2200 course Income Tax Return Preparation earn at least three IRS certificates within the first four weeks of the course: the Intake Certificate, the Volunteer Certificate and the Basic Certificate. Many students pursue an additional Advanced Certificate, including Carrie Doyle, whom I received assistance from with filing my tax return.

Doyle, a former paralegal and the owner of a BA degree in business, found the COVID-19 pandemic had left her “dissatisfied” with her career, and she decided to take the plunge in pursuing her passion for accounting. The versatility of the class provides her with a plethora of opportunities, including the option of becoming an accountant or earning her CPA.

She explained the difference between the basic and advanced return as contingent on the complexities of a consumer’s return; myself and, likely most COD students that are unmarried, working part-time and claimed as a dependent, constitute as a basic return, while the more complex situations that include marriage and real-estate ownership fall into the advanced return.

For the remainder of the course, Doyle further explains that she and her classmates act as VITA volunteers to “get their feet wet” in completing income tax returns. Moreover, she notes that 64 hours of practice through VITA is required for course credit.

However, because she and the other volunteers are students, the services are supervised by a COD accountancy faculty member who is also IRS certified. These supervisors mill around the computer lab that the service is conducted in, and upon a volunteer’s completion of a return, the volunteer raises their hand for the supervisor to check their work and submit the return themselves.

Additionally, consumers are required to complete two consent forms. The first is a VITA Tax Preparation Release form prior to obtaining the service that reiterates the service is student volunteer-based and releases the program from responsibility in the situation of any errors or omissions. An 8879 Consent form upon the completion of the service is also needed. It’s worth noting that the release form also provides a section for the consumer’s contact information in the situation of an error.

Doyle began the service by collecting my documents and then verifying my identity through my Social Security card. W-2 forms that arrive in the mail come with three perforated copies, and she explained VITA keeps one of those copies for their own records. She then entered the W-2 information into the online program and reviewed my completed intake form.

Doyle emphasized the importance of the intake form at this point in the process. It’s an extensive guide for volunteers in asking consumers the correct questions to secure them the largest and most accurate return possible.

“Based on the intake form, I can ask how you are filing this year [married vs. dependent],” she said. “I know to ask if you own a home, and if you do, I can get you a credit for it with the corresponding tax forms.”

Additionally, Doyle verified I had health insurance. Those who receive their healthcare through the Affordable Care Act, rather than through a parent or guardian’s private insurance, require a different procedure within the filing process. She said those unfamiliar with the meanings of their many tax forms can also provide those at this point in the service, and the volunteer can apply them correctly or altogether to a consumer’s tax return.

The supervisor, Rob Budney, checked Doyle’s work and submitted my tax return. It’s here that the consumer’s W-2 and Intake form are collected, and in exchange the consumer is provided with a large envelope containing a printed summary of the filed income tax return. This packet includes a summary of the service, a reiteration of the W-2 information, a copy of the 8879 consent form, a copy of the 1040 Individual Income Tax Return form and a Schedule of Illinois Income Tax Withheld form.

Consumers are able to provide direct deposit details for their tax return if they so choose. In filing my 2021 Income Taxes, I received a $100 tax return to my own surprise.

Sitting in the SCC lobby with nearly 50 middle-aged people and professionals waiting for their VITA appointments, it was difficult not to notice that I was likely the only person of my age group there. This depicts the popularity of the service amongst the older generations and that many people do take advantage of its value. Nevertheless, I received money back as an unmarried, dependent, part-time employed young student. So why aren’t other students taking advantage?